How are metal price trends affecting the Favorites? Part 2 Base Metals

Global tariff unease weighs on metal prices

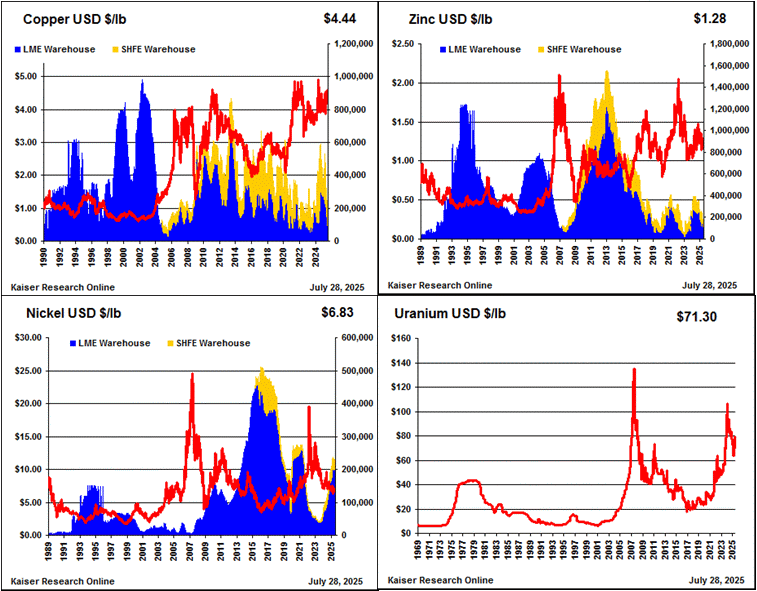

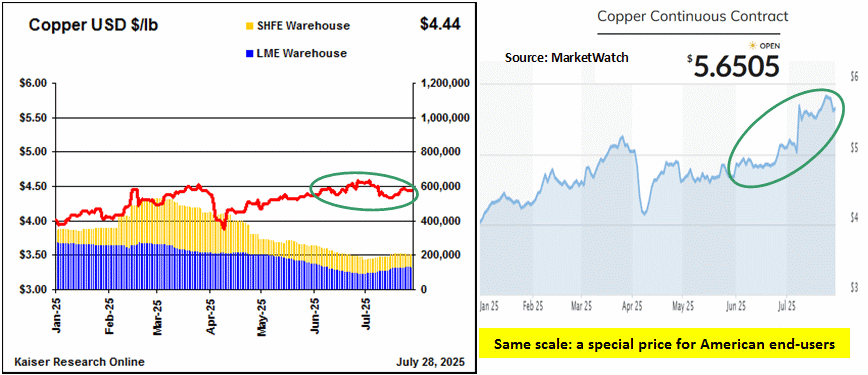

Part 2 of the Kaiser Watch Episode recorded on July 25, 2025 features KRO Favorites focused on base metals and uranium. Uncertainty about the impact Trump's tariffs will have on the global economy are keeping base metal prices flat except in the case of copper where a special 50% tariff on copper has caused the Comex copper price for delivery to American end users to diverge on the upside from the global LME spot price. This is helping US based copper juniors attract some attention, but the Comex copper cannot be used as a basis for assessing the economics of a copper project because this premium above global copper could vanish with the stroke of a pen. There is little positive to be said about nickel prices which are being dictated by Indonesian supply of dirty nickel. The strength in gold and silver is helping out base metal projects where gold and silver are by-products. Uranium gets lots of buzz from talk about small modular reactors eventually powering AI data centers, but the spot price in the $60-$80 range is not helping out uranium focused juniors where the market's attention is on discovery exploration results.

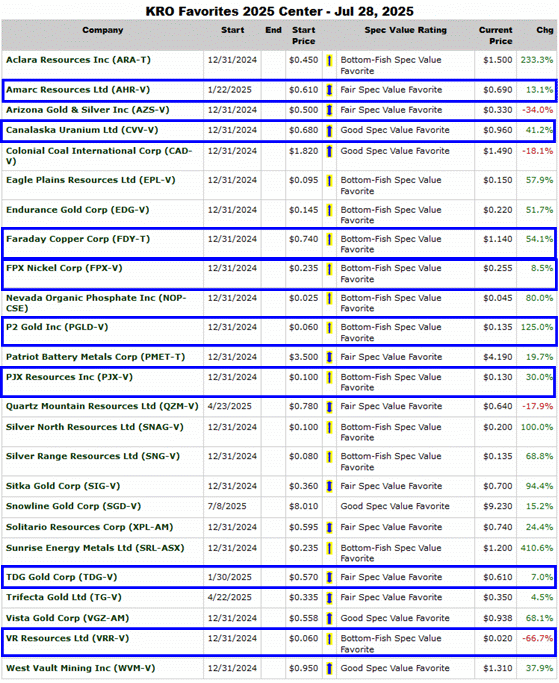

PJX Resources Inc, which is supposed to be taking a second crack this year at its Sullivan 2 Hunt on its Dewdney Trail project in southeastern British Columbia, is up only 30%. I started covering this story in late 2023 when they found Sullivan style zinc-lead-silver boulders in the talus of a mountain slope. What made this discovery interesting was the bedded nature of the mineralization which indicated a sea floor exhalative source rather than structurally controlled vein style mineralization as occurs at the nearby former Estella mine. Last year's drill program had a slow start due to permitting delays and by the time John Keating figured out that a Sedex massive sulphide deposit was not in the obvious place it was too late to do anything about it.

The issue is that what was thought to be a simple layer cake has undergone folding and faulting which makes the source of the talus boulders a lot harder to find. So they want to build a road into what they now think is the ideal angle to drill where they think the deposit ended up. Although they have an extensive 5 year permit, it still requires a biological sweep which can't happen until the area is accessible. The drilling area was burned out by a forest fire some years ago, and while the pine trees are growing back, the Canadian permitting agency is worried about the impact any disturbance might have on the comeback of the endangered pine bark beetle.

PJX has used the delay to raise $1.6 million through a private placement of of flow through and common units at $0.14 and $0.12, which gives it a financial cushion if drilling frustrates again this year. If they hit Sullivan style mineralization it will be massive sulphides with visible sphalerite, so we might not have to wait until October to find out if we finally have a Sullivan Two lunker on the line. Even though Sullivan would be worth $5-$10 billion today, I have assigned only a CAD $1 billion outcome target because at this stage we have no idea of the scale of the massive sulphide pile from which the boulders emanated.

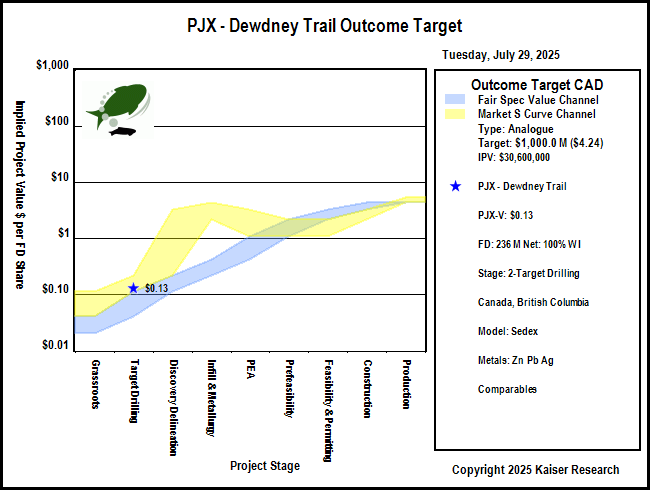

The price of copper continues to have a split personality where the LME spot price is languishing at $4.44 per lb while the Comex contract which is what American end users have to pay is at $5.65/lb. Comex is reflecting expectations that Trump will create a 50% tariff on copper imports with the laughable goal of stimulating domestic production. Even if you suspend all exploration and mine permitting an import tariff will not speed up discovery and development of new domestic copper supply. But it will certainly increase the cost of any domestically manufactured goods that require copper, which will not be pleasing to American consumers, and not competitive for export to the rest of the world which can purchase goods whose copper content cost is based on the global LME copper price. Wacko Copper Tariff deserves a TACO published July 14, 2025 goes into greater detail as to why this copper import tariff is counter-productive for the goal of reshoring manufacturing.

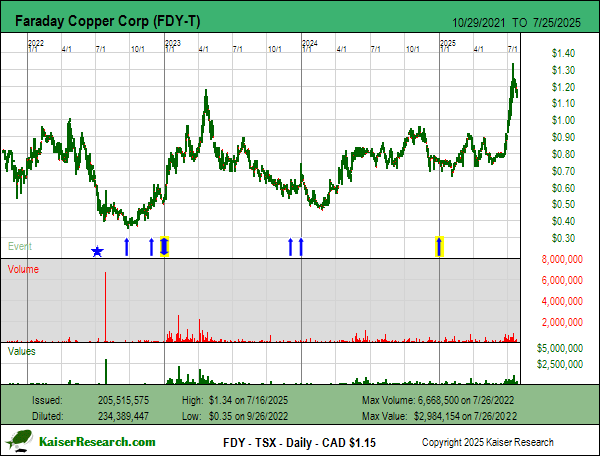

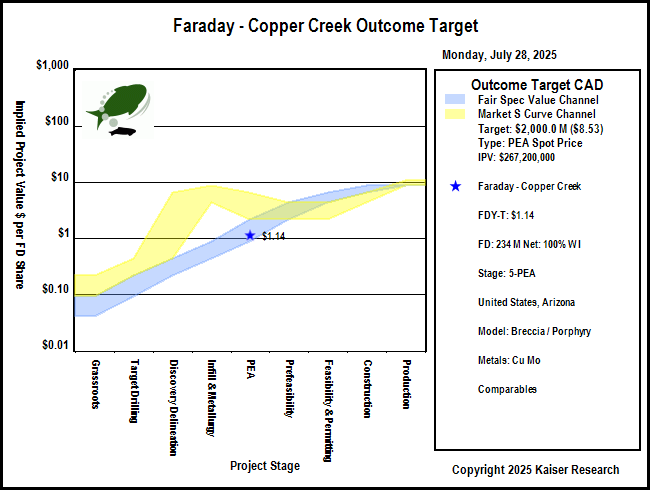

While we wait for a TACO to bury this WACKO idea it is helping two of our copper favorites. One is Faraday Copper Corp which I discussed in the last KW episode. Faraday is up 54.1% after getting an important BLM drill permit for its Copper Creek project in Arizona. On July 14 Faraday announced a $30 million bought deal at $1.10 which the next day was increased to $49 million. There is no warrant attached but as usually happens with a bought deal done at a discount to market it has caused Faraday's stock price to pull back. But with this financing Faraday is fueled up to continue work at Copper Creek which will include testing entirely new targets. Faraday is fairly priced for a target outcome of CAD $2 billion which would translate into a future stock price of $8.53.

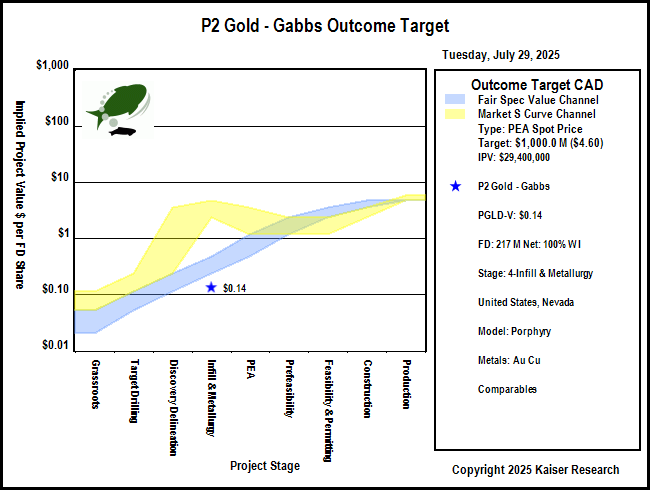

The other Favorite that stands to benefit from a Made in America copper price is P2 Gold Inc which is advancing its Gabbs copper-gold project in Nevada. P2 Gold is up 125% but not generating much market buzz because it is in the midst of metallurgical studies designed to improve the recoveries used in the 2024 PEA. It is also waiting for additional permits to allow drilling to resume. The balance sheet is still challenged with about $1 million owned to Joe Ovsenek and Ken MacNaughton plus a $1.3 million debenture due in January 2026 owed to Waterton, the Gabbs vendor. But this debenture is convertible at $0.10 so will likely be converted to stock.

What the market seems to be ignoring is that the PEA used $1,950 as a base case gold price, and showed that at $4.71/lb copper and $2,414 gold spot price back then the project has an after tax NPV (10%) of USD $530 million. CapEx was $366 million so at that price the project was in the money. Now suppose you plug in $5.50 copper and $3,300 gold in this mining scenario which is front-loaded with heap leached gold? That deserves a target outcome of CAD $1 billion. When the market stops fretting about a gold price collapse it will see P2 Gold in an entirely new light.

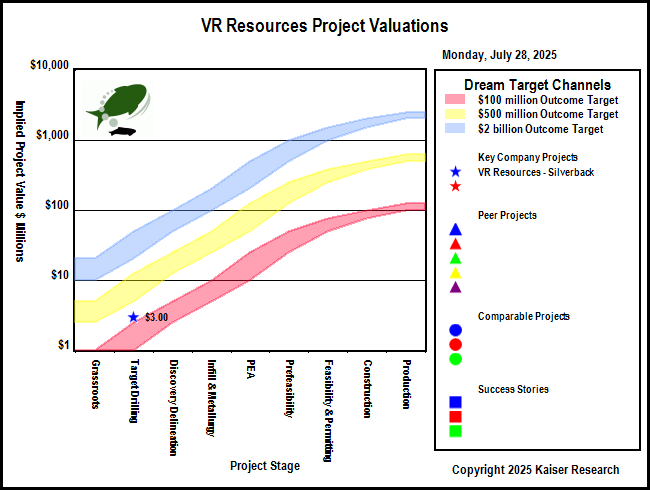

The worst performing Favorite is VR Resources Ltd, down 66.7% for the year after drilling at its Silverback target in Ontario earlier this year failed to deliver a gold discovery. That story is not yet dead and low cost target development work is being done this summer as management rethinks the potential mineralizing controls in this area. The WACKO copper tariff plan, however, is attracting interest to VR's Bonita and New Boston copper projects in Nevada. The hope is that strong farmout deals can be secured for these properties. I have not assigned a target outcome for any of these projects, but the market is pricing VR's drill ready 100% owned projects as fair value for a modest $100 million target outcome. A comeback before the end of the year is not out of the question.

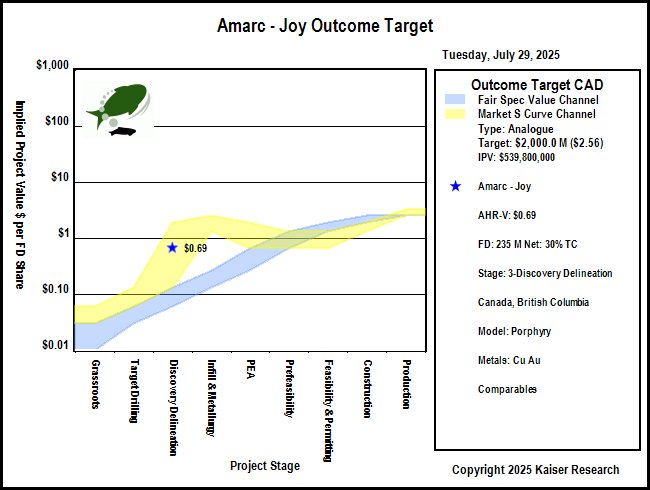

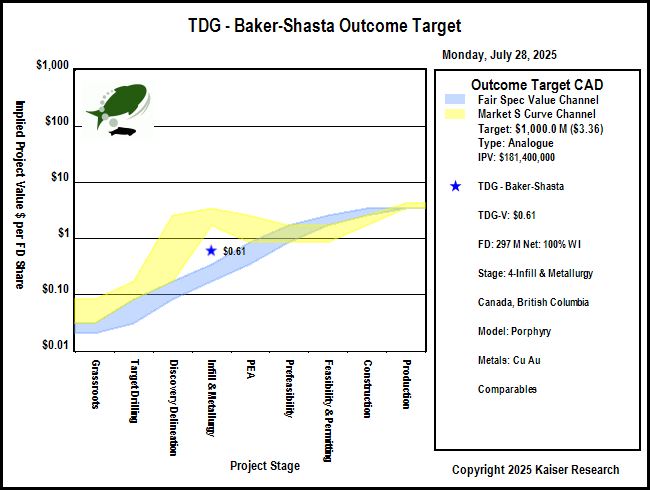

The Toodoggone District rethink play featuring Amarc Resources Ltd with its Joy project and TDG Gold Corp with its adjacent Baker-Shasta project is not benefiting from the Comex copper price or the gold spot price. Amarc is up 13.1% and TDG is up 7.0%, though they are up 254% and 352% from their Bottom-Fish Collection prices at the start of the year. I graduated both to the Favorites Collection after Amarc announced the gold and copper enriched Aurora discovery in January.

Freeport has technically vested for 60% in Joy but has not yet given formal notice which sets the clock ticking for a decision to go to 70% by spending another $75 million. Freeport has authorized a $10 million budget for the summer program which Amarc will not have to reimburse any part of if Freeport decides to stay at 60% and form a joint venture. Freeport has exercised its right to participate in the 100% Brenda option Amarc secured from Canasil, and has done an 80% deal with <B>Finlay Minerals Ltd</B> on the Pil and Atty properties. Amarc has declined to participate in Atty but is participating in the southern portion of the Pil property where its area of interest clause applies. Amarc thinks Freeport will elect to go to 70% but until it does we don't know.

A positive sign emerged on July 17 when Freeport decided to boost its 2025 Pil and Atty budgets from $750,000 and $500,000 to $2.6 million and $1 million respectively. The market has largely ignored this development. The Joy program will focus on finding the limits of the Aurora system so that Freeport has a better idea of the scale. This will involve big stepouts which could yield pleasant surprises. The downside risk is that Freeport is on a mission to make sure it has left no stone uncovered before retreating from the Toodoggone district. The value the market is assigning to Amarc's net 30% interest is in S-Curve territory, but that valuation is distorted by the fact that Amarc has the Duke project under option to Boliden and owns the Ike project 100%. The rational speculation model breaks down when a junior has multiple strong projects.

TDG Gold Corp has completed a geophysical survey which indicates the Aurora copper-gold system appears to extend onto its property and is drilling to test this extension. The survey revealed another deeper IP anomaly and they are expanding the survey to better understand what that is all about. Market interest in TDG has subsided after it decided to acquire the Anyox Copper project for 54,559,565 shares of which 25,461,430 shares went to 11 parties who are insiders of Skeena Resources Ltd. Anyox Copper is an environmental disaster site and I have serious initial doubts on the wisdom of acquiring this project which various groups have looked at during the past 20 years including an ASX listed company. The deemed price was $0.60 which makes Anyox Copper worth $33 million. I was not able to find a 43-101 technical report explaining what Anyox Copper is supposed to be all about.

When Skeena invested in TDG earlier this year none of the Skeena insiders had any stake in TDG. A hard question I would like an answer to is what the Anyox Copper vendors paid for their stake in that project and when. The presentation created to explain the Anyox acquisition is full of synergy blah blah blah and very little technical information about the project fundamentals. The story is the simple one of where there is one VMS deposit there will be more, possibly bigger and better than what was mined out. That's fine, but that story is not worth $33 million. TDG has also proposed a 5:1 rollback, which really makes no sense given that TDG has now raised $45 million this year. Because of the uncertainty to what extent Baker-Shasta has a full sized copper-gold porphyry target I have only assigned a CAD $1 billion outcome target, which if achieved, would result in a future price of $3.36 based on 297 million shares fully diluted. Had I known the Anyox Copper acquisition was in the works I would have left TDG Gold Corp in the Bottom-Fish Collection.

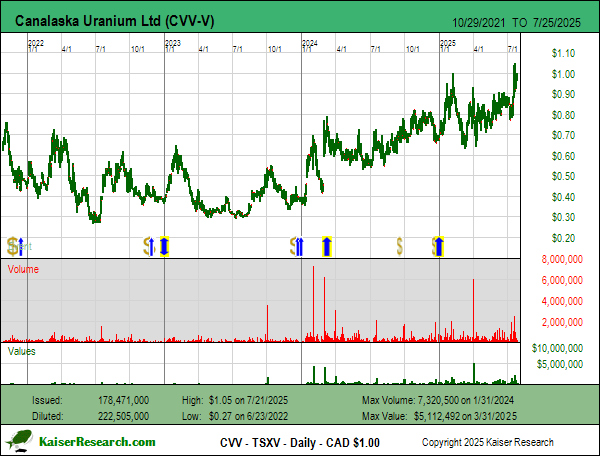

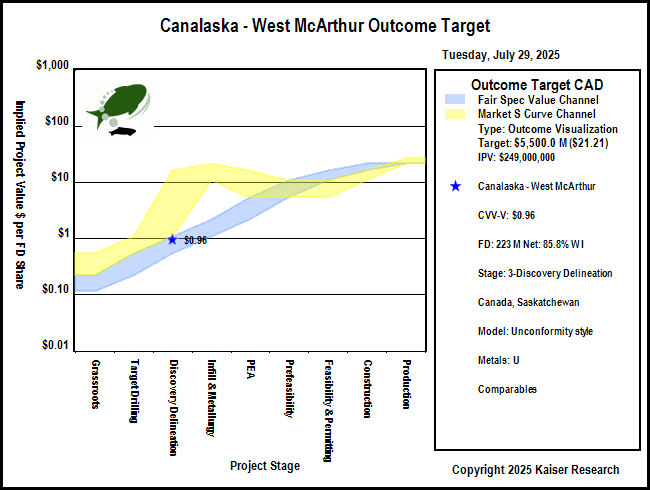

The uranium price has had a nice rebound from its mid $60/lb bottom earlier this year and nearly made it back through $80 but has since fallen back to the $71/lb level. None of this is responsible for the 41.2% gain <B>Canalaska Uranium Ltd</B> has delivered so far this year. What is driving Canalaska is ongoing delineation of the high grade Pike Zone at West McArthur which is starting to come together, plus a summer plan to hit other targets within the structural corridor in search of similar pearls on the string.

The recent price boost came when Canalaska delivered geochemical assays for the winter drilling that were substantially higher than the radiometric readings from the downhole probe which has a reading limit. These are the highest grades yet achieved and push the story closer to the idea of a McArthur clone, though the stock has yet to exhibit S-Curve market action that should accompany a CAD $5.5 billion value for a McArthur clone which would equate to $21/share according to the Outcome Visualization I have created. The reason Canalaska has remained fairly valued for this outcome at the discovery delineation stage is that the market, while accepting a McArthur clone as plausible, still has its doubts. That could change with this summer's drill program.

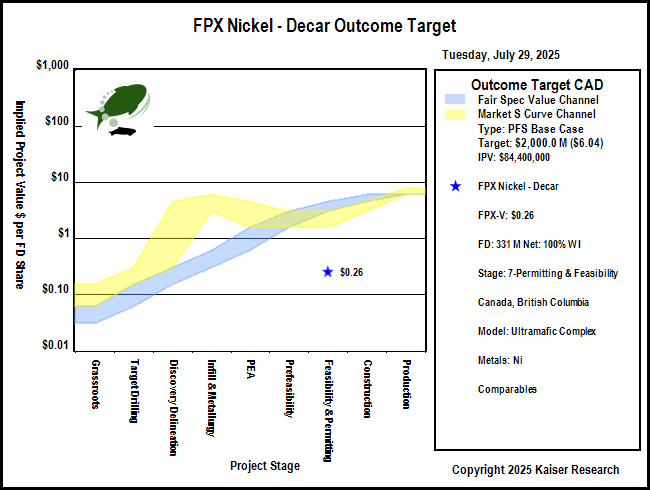

The price of nickel continues to suffer from the flood of dirty Indonesian nickel in a world that Trump is forcing not to care about clean energy. <B>FPX Nickel Corp</B>, which is moving the Decar project through a feasibility study, is up only 8.5%. The most recent news is that FPX has bought 720,000 of its own shares at an average price of $0.24 as part of a normal course issuer bid, which makes no sense because the company has already conceded it will need to raise more money to complete its feasibility study. The 2023 PFS for Decar generated an after-tax NPV at 8% of CAD $2 billion using $8.75/lb as a base case price for nickel. This is a very large scale, long lived mining scenario whose virtue is that the nickel output will have a very low carbon footprint. But at the current price below $7/lb Decar is utterly worthless if global spot prices dictate production decisions.

Most of the $60 million FPX has raised during this iteration of the awaruite story has come from three strategic investors, Outokumpu the Finnish stainless steelmaker, Sumitomo the Japanese mining company, and a third mystery investor which most likely is Japanese and might even be Toyota which is commercializing a solid state lithium ion battery that requires nickel in the cathode. Work has been done to demonstrate the technical feasibility of converting the ferro-nickel output into battery grade nickel sulphate. The story is trapped between the flood of cheap dirty nickel from Chinese backed Indonesian supply and the Trump administration's disavowal of anything to do with the energy transition, and in fact pollution mitigation in general. FPX Nickel is not a story for retail investors unless they wish to treat it as a contrarian bet that Trump's race to the bottom for America will fail. The value assigned by the market to Decar indicates that this bet is viewed as a longshot.

Disclosure: JK owns PJX Resources, TDG Gold and VR Resources

Jacques Bonneau recently published an excellent book about the junior resource sector which is an mandatory primer for newcomers and a good refresher for people like myself who have been immersed in this sector for decades. It includes a priceless "red flag" section. It is called "The art of investing in junior mining" and can be ordered from Amazon.

https://www.amazon.com/art-investing-JUNIOR-MINING/dp/2982288117

John, you've got a wealth of knowledge about the geological similarities to other projects (and great recall for matching those up). I'm curious if you're aware of any books that would help get someone up to speed on such topics for investing purposes, not a PhD.