Breakthroughs and New Hypotheses - Toxic Tesla

How are your Favorites and Bottom-Fish Collections holding up?

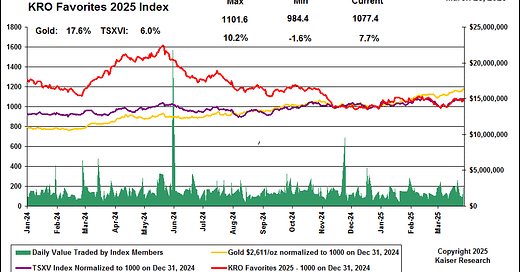

As of March 28, 2025 the 22 company Favorites Index was up 7.7% for the year compared to the TSXV Index at 6.0% while gold was up 17.6%. The 108 company Bottom-Fish Index in contrast was up 26.3% though it tracked sideways during the second half of March. There is still no evidence that investors are embracing resource juniors.

The good news is that gold has managed to stay above $3,000 thanks largely to Donald Trump's efforts to tank the global economy through his tariff strategy. Although during the past week the GLD ETF gained only 46,011 ounces, its total holdings are the highest since June 20, 2023 when it held just over 30 million ounces. It has gained 1,910,616 ounces since the start of 2025.

Major US equity markets look like they want to fall off a cliff, as does bitcoin, but so far a market crash has not yet happened. For example, the resilience of Tesla is quite amazing given how toxic Elon Musk's brand has become for both the left and right bottom prongs of the Belief Horseshoe. It is the fundamentals, however, that threaten to destroy market faith that Tesla will dominate the EV future. Warren Buffett backed BYD is going to crush Tesla in China, BYD's self-driving technology may be better than Tesla's, the newer versions charge faster than a Tesla, and import tariffs on metals will not lower the Tesla cost to an affordable level.

Tariffs will prevent BYD cars from penetrating the American market, but that may not be a problem outside of the United States as the world develops strategies to avoid trade with the United States while cultivating trade with each other. Given how Musk has aligned the Tesla brand with Trump's America against everybody policies, what nation's consumers would buy a Tesla today instead of a BYD electric vehicle? Tesla has a big manufacturing base in China, but given that America's reasonable goal of reducing import reliance on Chinese goods which will involve punitive tariffs, how hard would it be for Beijing to encourage Chinese consumers to shun Tesla in favor of domestic brands?

Tesla may try to export its Chinese made EVs to Europe and Canada, but Europeans and Canadians are no longer interested in buying Teslas, especially Europeans not thrilled about Musk's enthusiasm for Nazi sympathizers as well as that of JD Vance, Trump's heir apparent. And of course what self-respecting liberal would today buy a Tesla? Some that own one are putting a sticker on the back declaring "I bought this before Musk went nuts".

What about the MAGA crowd to whom Trump recently pumped the idea of buying a Tesla? Why would a MAGA person who believes along with Trump that climate change is a hoax and that "drill baby drill" will result in cheap gasoline prices while AI, bitcoin mining and air-conditioning needs drive up electricity costs buy a Tesla? Now a MAGA person may like the thuggish look of a CyberTruck, and one sees plenty of them now in urban settings, but a rural MAGA dweller might embrace common sense and prefer a more robust truck whose parts don't come unglued.

Then there is the problem of both left and right prongers being equally eager to vandalize a Tesla. The right prongers see a Tesla as a symbol of the energy transition that would deprive them of their trusty ICE cars, and the left prongers see the Tesla as a symbol of Musk's endorsement of Trump and even worse. Soon the used car market will be flooded with Teslas by owners seeking to escape the risk of finding their car keyed or worse, such as a flat tire. The Tesla does not carry a spare. You need a special wrench to remove a Tesla wheel which Tesla doesn't let car parts retailers sell and don't come with a Tesla purchase. If you get a flat tire don't call AAA; you need to call Tesla and they will send somebody to fix it for $130, though how long that will take is unknown, and heaven forbid you are out of cell range. As the used car lots fill up with Teslas old enough to start developing electronic problems that only authorized Tesla dealers can fix, who will want to buy such liability black holes?

The toxicity of the Tesla brand is only going to get worse. Musk's DOGE committee has been hacking away at branches of the US government representing less than 10% of the federal budget which is killing America's ability to project soft power into the rest of the world and will eventually create ripple effect problems at home. The MAGA base doesn't care much about that now, but what happens when Musk goes to town on the $5 trillion portion of the $7 trillion federal budget that keeps the poor, sick and old alive so that the one-percenters can enjoy tax cuts?

These people include a good portion of the MAGA base. The iconic visibility of a Tesla car which helped it become such a popular brand becomes a liability when the brand becomes toxic to both left and right prongers. How long before there erupts a contemporary version of Kristallnacht, the Night of the Broken Glass on November 9, 1938 when Nazi thugs smashed the windows of Jewish stores and buildings? That was organized by Hitler's thugs, but today the algorithms of social media can far more quickly and efficiently mobilize a mob, a very dangerous mob because the opposite ideologies of the participants with a shared object of scorn will not be obvious, especially if the participants don the MAGA hats and Antifa black masks of their "enemies" as false flags. Steve Bannon, an early architect of the autocracy vision for America's future, has already pegged Musk as an "enemy of the people", so both sides are primed to loathe Elon Musk as a symbol of everything that is going wrong.

To a large degree Tesla's stock price has become a barometer for Trump's popularity, but Musk is being set up as the fall guy for when the plug is pulled on that major part of the federal budget which keeps alive the poor, sick and old. And once Musk's paper wealth begins to shrivel, so will his ability to pay for influence. It has been floated that a Magnificent Kneebender like Apple might acquire Tesla, but that still leaves unanswered the question, who will be the future American audience for a Tesla EV in an environment where the energy transition has been given up on and consumers are settling into a mode of adaptation to the End Times? It's no wonder Tesla has become a target for short-sellers.

Bitcoin has also proven remarkably resilient as it sits poised at the edge of a cliff after retreating from its post Trump election victory peak. There is now a battle royale between gold and the Tesla-bitcoin symbols of the Trump administration's popularity. Every time senior equity markets lurch down my screen of 500 resource juniors turns red as that tiny audience which still has exposure to this sector cringes in anticipation of a Q4 2008 style washout. The same happens when gold has a down day because the general fear among retail investors remains that this time is no different than before, that gold will soon enough crash back below $2,000.

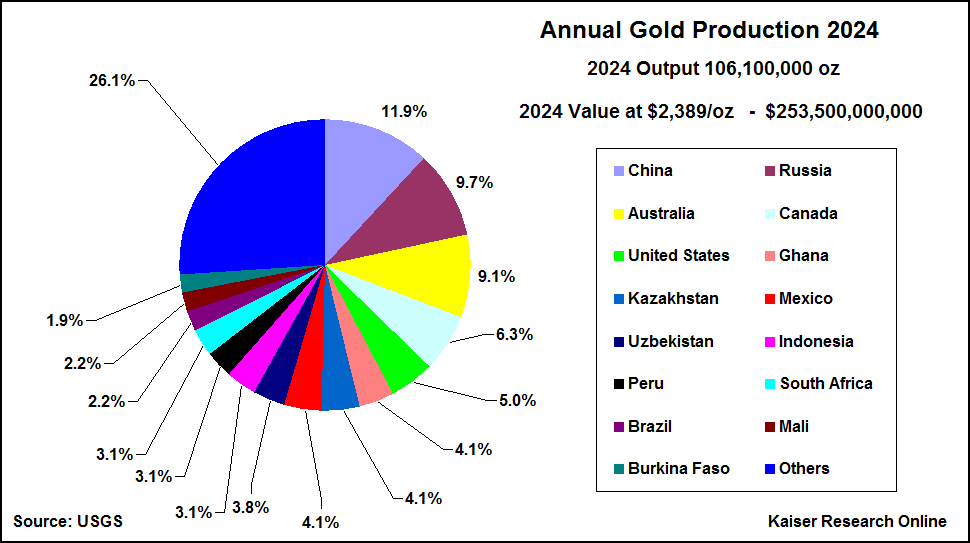

We need to get this market crash over with before money will start flowing into the resource sector. Only then will a "reset" mentality kick in, which will include getting serious about a domestic supply of raw materials and even gold. On March 20 Trump finally got around to doing something useful for America, namely making an executive order which instructs government agencies to fast-track exploration and development permitting. In addition to formally defined "critical minerals" he lists uranium, copper, potash and gold as "minerals" covered by this order. Including gold doesn't really make sense unless Trump deep down knows his policies will undermine the US dollar as the global reserve currency and America better have a domestic supply of mined gold commensurate with that of China and Russia, the world's top two gold producers (the United States is in fifth place). It's too early to see to what extent the executive order speeds up the permitting process, but agencies such as the BLM and USFS are now on notice that their health insurance style approach of "deny and delay" is no longer acceptable.

My new Kaiser Watch Substack is up and running and next month the KRO Individual Membership switches from $450 for 2025 to the KRO Pro Membership at $200 per month. Former subscribers will still have a chance to renew at $450 though the longer they wait the less valuable that membership becomes. Newcomers can subscribe for my $10 per month Substack service. Although Kaiser Watch as an audio show is mainly focused on the KRO Favorites, Kaiser Watch Substack will start to serve as a low cost platform for written comments. With all the work setting up KW Substack and seeding it with the 2025 Favorites introductions pretty much behind me, I will focus on publishing Trackers on KaiserResearch.com about members of the 2025 Bottom-Fish Collection. On a selective basis I will start reposting them on KW Substack to help educate a new audience about how to think about resource juniors that can be accumulated while the stock is still crawling along the bottom ahead of seeing the missing pieces fall into place. This KW audio episode provides updates on Favorites Endurance Gold Corp and VR Resources Ltd and introduces a bottom-fish called Bold Ventures Inc.

"We need to get this market crash over with before money will start flowing into the resource sector." Be careful what you wish for...

March 20, Washington's "Immediate Measures to Increase American Mineral Production" should be something every mining expert is concentrating on right as it ranges from extraction to smelting - it's happening in no other Western economy.